Access intelligent products and services, browse informative financial content, use money-savvy tools, join the JustMoney community, and be rewarded!

Access intelligent products and services, browse informative financial content, use money-savvy tools, join the JustMoney community, and be rewarded!

16 February 2026 · Fiona Zerbst

Learn whether you qualify for a debt consolidation loan in South Africa. Discover requirements, benefits, and how it can help pay off your debts.

6 February 2026 · Fiona Zerbst

Confused about how debt consolidation loans work? Learn the pros and cons, and the credit score impact in South Africa.

13 November 2025 · Fiona Zerbst

Learn how to secure a business loan in South Africa. Discover what banks require, the types of business loans available, and tips to prepare a strong business plan.

15 October 2025

Some 5,500 survey responses reveal that despite substantial financial pressure, South Africans remain resilient and resourceful.

15 September 2025 · Fiona Zerbst

Compare interest rates, fees, and total repayment costs of personal loans and credit cards in 2025. See real-world examples, expert tips, and tools to help you save.

8 August 2025 · Fiona Zerbst

Learn how to sell a financed car in South Africa, settle your vehicle loan, avoid default, and explore your debt counselling options.

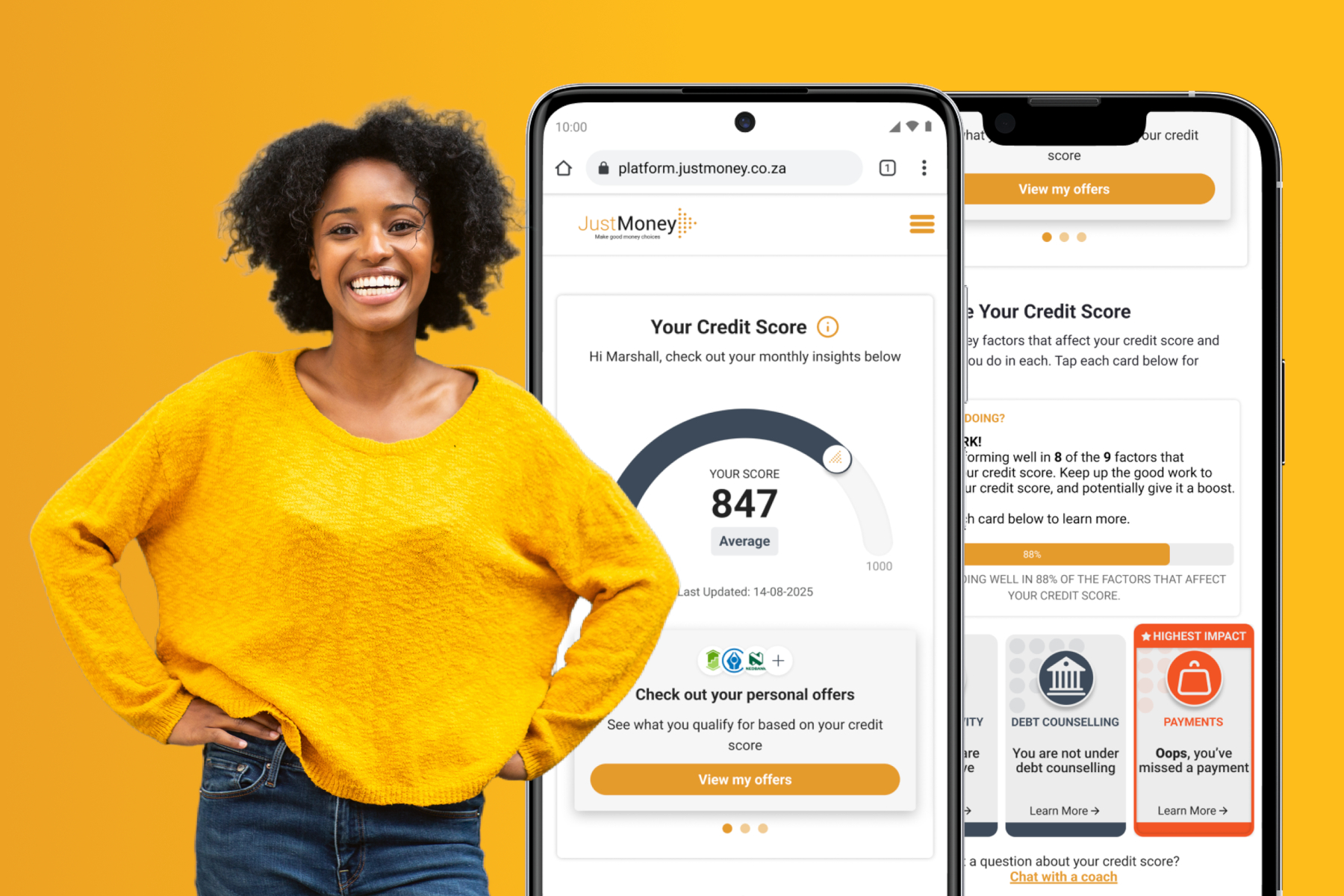

With a track record of close to two decades, JustMoney offers you FREE, quick, and easy access to financial solutions tailored to your needs. Whether you aim to save, invest, get credit, rehabilitate your finances, insure your assets, or monitor your financial health, we’ve got the tools to help you make good money choices.

We’ve hand-selected the most value-laden partners to bring you solutions and services that will build your financial health.

Register and access financial products and services tailored to your financial needs.

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2026 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.