This article highlights the importance of taking meaningful steps towards securing your financial future and outlines strategies proven to work for savers.

22 January 2023 · Fiona Zerbst

Most of us are aware of the wise assertion that “it’s never too early to start saving for retirement”. For many of us, however, retirement seems so far removed that we don’t save as we should.

This article highlights the importance of taking meaningful steps towards securing your financial future, and outlines strategies that have been proven to work for savers, such as capitalising on compound interest.

Tip: Unit trusts can help you take advantage of compounding growth. Find out more here.

Why you shouldn’t delay investing

Paul Menge, an actuarial specialist in Momentum Investo’s product solutions team, illustrates what you can achieve by the age of 65 years, if you start with a monthly investment of R1,000 at four different ages.

The figures in this example assume a growth rate of 11% per year, and an inflation rate of 6%.

|

Start saving at age: |

Retirement value at age 65 |

Real value today |

|

25 |

R3,880,000 |

R377,000 |

|

35 |

R1,566,000 |

R152,000 |

|

45 |

R572,000 |

R55,000 |

|

55 |

R169,000 |

R16,000 |

“R4 million sounds like a lot of money, but 40 years from now, it won’t buy you much,” warns Stanley Gabriel, CEO of Momentum Investo. “The earlier you start saving, the more time your money has to work for you.”

Cherise Erasmus, a financial planner at Crue Invest, agrees that time is an investor’s best friend.

“While it’s not always possible to put extra money away for your future, it’s crucial to understand the effect of delaying your savings plan,” she warns.

“Compare two investors, aged 25 and 40, who both want to retire at age 65 and have the same expenditure goal for retirement. The 40-year-old investor will have to save 150% more every month than the investor starting at age 25, assuming they are saving in the same investment fund.”

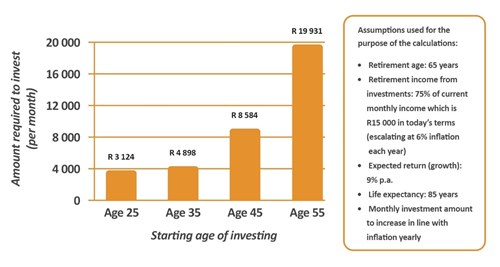

Financial services provider Beanstalk provides a graphic illustration of how much you need to invest every month, at different ages, to achieve your financial objectives. The growth rate assumed here is 9% annually.

This is based on an income of R20,000 a month with a retirement goal of 75% of your income, that is, R15,000 - although this would escalate in line with inflation every year.

If you only start investing at age 55 – that is, ten years before you retire – you will need to invest 6.4 times per month than if you’d started at the age of 25, according to the graph.

These examples illustrate why investing early is not a luxury, but essential, if you hope to keep up with inflation.

Having to save extra for retirement while paying off a home or vehicle loan, or putting your children through university, for example, is also avoided in this way.

The advantages of early investment

Early investing allows you to take advantage of compound interest, which is interest earned on your interest. “It shows time is your best money friend,” says Gabriel.

Consistent investment over 25 years would look as per the table below, assuming annual growth that matches the inflation rate, that is, 6%. This assumes 10% growth in total after 4% is paid out in adviser, platform and investment management fees.

In the example below, 10% of your investment value after the 25-year investment period is made up of the contributions you made during the first 10 years of the 25-year period.

Furthermore, 40% of the investment value after the 25-year period comes from the growth on the contributions you made for the first ten years. The same principle applies for the last 15 years of the 25 years.

|

Contribution and investment growth |

Portion of total investment after 25 years |

|

First ten years of contributions |

10% |

|

Last 15 years of contributions |

25% |

|

Growth in the first ten years of contributions |

40% |

|

Growth in the last 15 years of contributions |

25% |

“The growth on the initial ten years of contributions is what contributes most to an investor’s portfolio,” says Erasmus.

She notes further that early contributions help to allay financial anxiety. Some late savers begin saving in a “bear market” – meaning, when returns are low - which may further compromise their financial position.

She also notes that there are tax incentives for contributing to an approved retirement fund, with tax rebates helping you to achieve your retirement objectives.

It’s ideal, says Gabriel, to work with a financial adviser, who can help you make sense of the figures.

“Financial advisers are qualified to provide you with financial advice. They can consider your current salary and calculate what you should save if you want the same or better standard of living one day,” he says.

“Even if you earn a salary and contribute towards a pension fund, you may still want to supplement your savings.”

Tip: Every contribution to a retirement annuity reduces your tax liability. Find out how you can save today.

}Free tool

info@justmoney.co.za

4th Floor, Mutual Park, Jan Smuts Drive,

Pinelands, Cape Town, 7405

© Copyright 2009 - 2025 · Powered by NCRCB29

Terms & Conditions

·

Privacy Policy

·

PAIA Manual

View your total debt balance and accounts, get a free debt assessment, apply for a personal loan, and receive unlimited access to a coach – all for FREE with JustMoney.